Making a Statement and Setting the Pace in (Very) Large Case Underwriting

Underwriting in the large case life insurance market has always had its challenges. Client and advisor expectations are high, and the demands for convenience, ease and speed are often at odds with the circumspect and proven procedures that carriers require when mistakes can be costly for all parties involved. So when it comes to innovation in large case underwriting, there is often an abundance of caution before making changes to existing guidelines, standards and processes. The primary reasons for this trepidation are typically adverse risk selection and mortality. Because of this, carriers have for the most part narrowed their innovation to applications in the $1-to-2-million-dollar range to mitigate potential negative impact. While this is positive industry progress, these models do little to address the large, multimillion face amount market where many of us stake our careers and success.

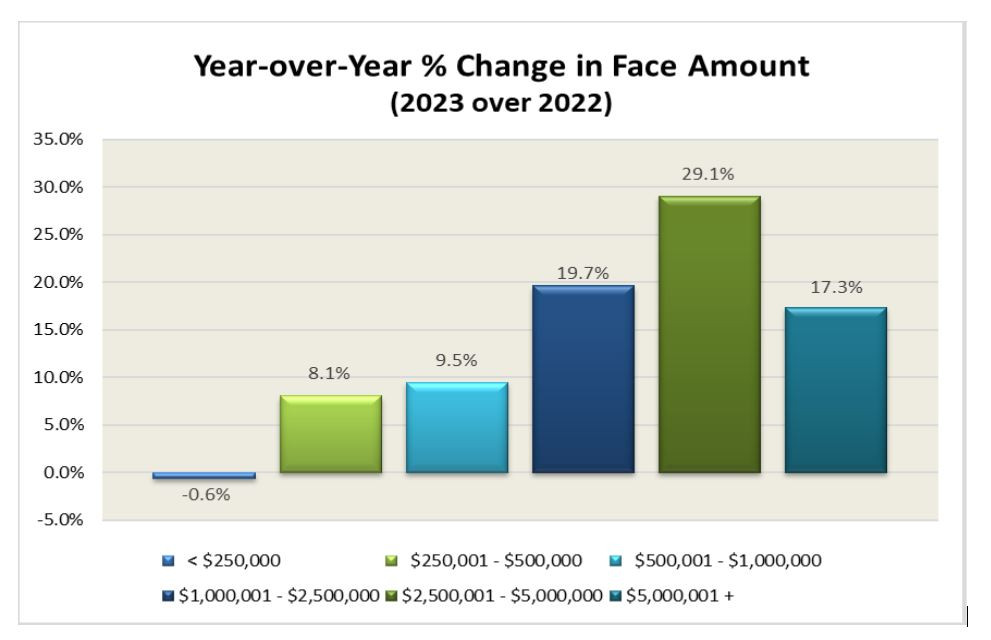

Large face amount application growth is occurring, as you can see below from the MIB Life Index 2023 Annual report. MIB's 2023 findings show a year over year double digit increase in application activity for face amounts above $5 million in nearly all age bands. *

This doesn't mean large case process improvement has been absent. A handful of carriers have implemented new approaches and gotten portions of the large case process right without adverse risk selection or sacrificing mortality. However, even with these models a key piece is often missing for making the process truly effective for both distribution and our retail customers.

Recently Pacific Life has taken a big step forward with a dramatic restructuring of underwriting in the large case market. The key features of their approach are smart and forward thinking. It addresses missing items from other large case models and sets the pace for things to come in the large case market -- with the hope that others will follow.

So, what has Pacific Life done and how is this new and different?

- Introduced a streamlined underwriting process by using readily available physician and related health data in lieu of insurance exam and lab results for up to $65 million of coverage. These are situations where the proposed insured has had a complete executive physical or exam in the past year or two, substituting an APS for an insurance exam. There are a limited number of similar processes offered by other carriers in the industry today. However, only John Hancock can match the capacity and substandard rating categories Pacific Life offers. Other carriers are more restrictive on face amounts and will only consider standard or better rate classes.

- Leveraged the streamlined underwriting process with an underwriting rewards program to improve risks by up to 4 classes, to include standard up to super preferred. Many carriers have crediting programs but limit the amount of risk class improvement to a maximum of 2 or 3 rating classes. Also, some limit substandard ratings to be improved to standard only.

- Introduced streamlined access to $80 million of capacity beyond internal Pacific Life retention on an Auto-Excess basis for applicants up to age 70 and through table D. This is huge and a major differentiator for Pac. When taken with their internal retention of $20mm of single life or $25mm of joint life, this allows Pac (with some restrictions) to offer capacity of up to $100mm on a single life or $105mm on a joint life basis. No other life insurer in the industry comes close to these amounts.

How would this play out on jumbo cases?

Let's say we have a 65-year-old male who has a $150 million dollar estate and is looking for $100 million of coverage for estate planning purposes. There is no coverage in force at present. His medical history is standard, but he has terrific risk factors, good family history, exercises regularly and has done all necessary age-appropriate prevention and screening tests which allows for a Super Preferred risk class.

In this scenario the policy can be approved on a Super Preferred basis in just a few days.

How would this contrast to others in the industry?

Because this case breaches the typical industry jumbo limit amount of $65 million, it would need to be facultatively shopped (i.e., sent to reinsurance for review and acceptance) for any amount beyond the internal carrier's retention. Let's say the carrier being applied with has an internal retention of $10 million and is also considering the applicant at Super Preferred as a stretch medically.

This all leaves us with a much more difficult path to navigate since —

- The carrier in question needs to have access to an additional $90 million of capacity in the reinsurance market. If they do have access to this level of capacity it may involve 4 or 5 reinsurers that need to be coordinated. This takes a significant amount of time and effort.

- The reinsurers involved may not agree to the rate class offered by the submitting carrier.

Considering the substantial premium involved with large cases, the task at hand is more time-consuming and comes with much greater uncertainty to reach a successful conclusion.

Pacific Life's streamlined underwriting program, rewards risk class upgrade approach, and its unmatched $100 million capacity all combine to provide unprecedented ease and alacrity to an important and critical process that has been cumbersome, slow, and at times counterproductive for too long.

As you can see, Pacific Life has taken the large case market to a new level. It's faster, easier and places decision making in the hands of people we know and deal with daily. They get it. Let's hope others will as well.

Comments