The Real Costs of Waiting - Part One

You've met with your clients and their financial advisors on a few occasions and discussed the clients' financial planning and insurance objectives. Things are going well. The insurance plan and product you are proposing meet the clients' needs exceptionally well, and provide the financial stability they are seeking. But then you hear it. The clients want to think about it some more. When queried, your clients indicate that maybe they will look at this again, but are not sure when that will be.

We have all heard it many times before, and know that procrastination and the risks that come with waiting can be costly. Depending upon how long it takes the clients to reengage these may include:

- Carrier price increases

- Carrier product limitations, with some products eliminated completely

- Client health changes

- An unexpected client death where there is no benefit at all

While these are all very important considerations that any client should be made aware of before deciding to wait, we want to take a deeper dive and explore one of the items above in more detail which has been particularly difficult to quantify. This concerns health changes and more specifically underwriting rate class changes that can occur with aging.

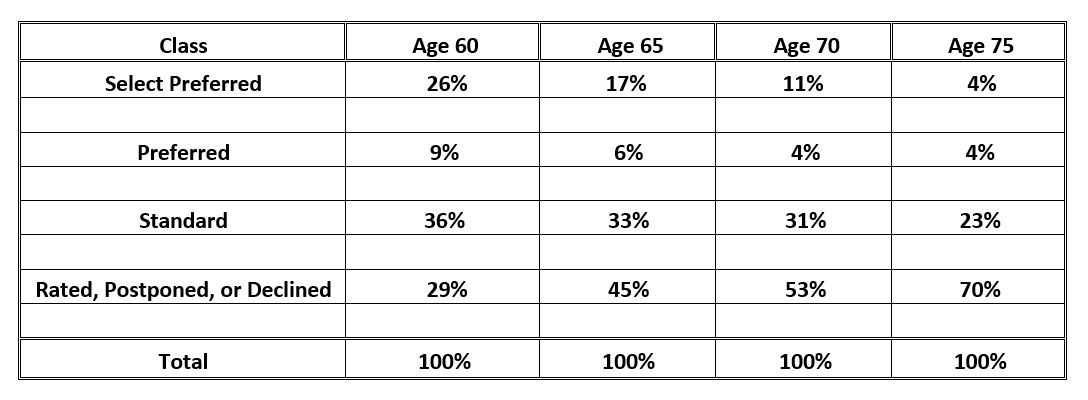

We recently came across one carrier's data showing various ages and the percent of applicants qualifying for certain underwriting classes. The carrier was willing to share this information with us, but asked not to be identified. However, their data is instructive.

It's fairly intuitive that when one ages the ability to qualify for more favorable underwriting diminishes. The table not only supports this notion but quantifies it. Furthermore, in this day and age of COVID underwriting restrictions, some carriers will not offer any coverage past a certain age, rate class and/or type of impairment which may further impede the ability to qualify for coverage.

Bottom line, health changes and subsequent underwriting class changes due to aging can make premiums onerous or even unreachable — assuming one doesn't become uninsurable in the process.

Let's look at some cases that help illustrate the costs of waiting with aging and underwriting health class changes.

Example 1

Adam is a healthy 60 year-old applying for $1 Million of Guaranteed UL coverage to Age 100. At the Select Preferred rate from a top industry carrier his premium is currently $14,892.

At current published rates:

- If he waits 5 Years that premium will be $19,980 — a 34% increase

- If his health declines to Standard rates (probability at 33%), it jumps to $26,724 — a 79% increase

- If he waits 10 Years, the Select Preferred premium will be $28,464

- If his health declines to Standard rates (probability at 31%), it jumps to $36,336

- If his health declines due to an illness that results in a Table 2 rating (the rated, postponed or declined category in the table) the premium jumps to $46,510. A hurdle of 320% more than his original Age 60 outlay.

Example 2

Alex is a Standard risk 65 year-old applying for $1 Million of Guaranteed UL coverage to Age 100. His premium would cost $26,724 today.

At current published rates:

- If the waits 5 Years that premium will be $36,336

- If his health declines to a Table 2 (a probability rate of 53%), it jumps to $46,510 —almost $20,000 more annually than the age 65 Standard rate!

- Even if the client saves the dollars that he does not spend on coverage over 5 years, the cross-over point is only 2.2 years before that savings has been consumed by the higher coverage costs.

We all would love to become healthier as we age, but we know that is not the reality.

Additionally, insurers pull products and raise rates all of the time. So it is very possible we may end up with an inferior, more expensive product in the future.

The cost of waiting doesn't just apply to death benefit sales either - in Part Two, we'll discuss how putting off the purchase of life insurance has a major effect on cash accumulation and future values for today's dollars.

More to come!

Comments