Underwriting in the large case life insurance market has always had its challenges. Client and advisor expectations are high, and the demands for convenience, ease and speed are often at odds with the circumspect and proven procedures that carriers require when mistakes can be costly for all parties involved. So when it comes to innovation in large case underwriting, there is often an abundance of caution before making changes to existing guidelines, standards and processes. The primary reasons for this trepidation are typically adverse risk selection and mortality. Bec...

Artificial Intelligence (AI) is top of mind today in the business community and elsewhere, and if estimations are correct will continue to be so in the future. It has been described in terms such as "transformative" and "next level," and promises to be just that. And since computer systems perform tasks, it is predicted to offer a myriad of efficiency, productivity, complex problem solving and other important benefits. The uses of AI are potentially limitless, especially in the life insurance industry where business is based upon knowledge and data. To better understand AI and what the future ...

The future is uncertain; however, at times one gets a glimpse of possibilities that may soon have enormous impact on underwriting. In addition, there are several developments affecting underwriting and the life industry today, especially concerning the regulatory environment and the use of data and algorithmic solutions in life underwriting. All of this and more was presented and discussed at the recent Association of Home Office Underwriters (AHOU) meeting. This year's AHOU was the largest on record with nearly 1000 attendees. Participants included underwriting leadership from all major life ...

Much change has occurred in underwriting and the underwriting process during the past couple of years. A great deal of this has centered on how to make life insurance more accessible for prospects who are demanding a faster, better and less invasive application process. While at the same time, carriers attempt to balance these changes with predictable mortality results. To understand what's happening in the underwriting industry and what the future may hold, we engaged three high profile underwriting industry experts and thought leaders to answer a few questions about their views o...

After a two-year hiatus, the Association of Home Office Underwriters (AHOU) was held recently in person with over 900 attendees present. Meeting participants included underwriting leadership from all major life carriers, reinsurance companies, exam/lab vendors, industry data/information providers and several technology companies among others. It was terrific to be back in person at this meeting, networking with industry pros and peers, and gaining important insight and perspective on the current state of life underwriting. Over the past few years and accelerated by the pandemic, th...

What an extraordinary year it has been for life underwriting. We've experienced rapid and remarkable changes on a number of fronts — some positive and helpful, others more challenging — and all either accelerated by, or initiated because of, the COVID-19 pandemic. We've seen the expansion of technological enhancements and automation of the underwriting process, helping get cases approved more quickly and with less hassle for our applicants. Conversely, we continue to see COVID-related underwriting restrictions that sometimes affect our ability to get coverage issued, especially wit...

With only a few carrier exceptions, enhancement and streamlining of the underwriting process over the past few years has primarily focused on cases in the $1 to $3 million range, with a maximum age 60 limit and qualifying rate classes of standard or better. While these applications cover a wide swath of carrier submissions, they typically fall short both for large case applicants who desire an expedited, less invasive underwriting process, and for opportunities that truly move the premium dial for producers. John Hancock stepped up big time recently and developed a solution to this large...

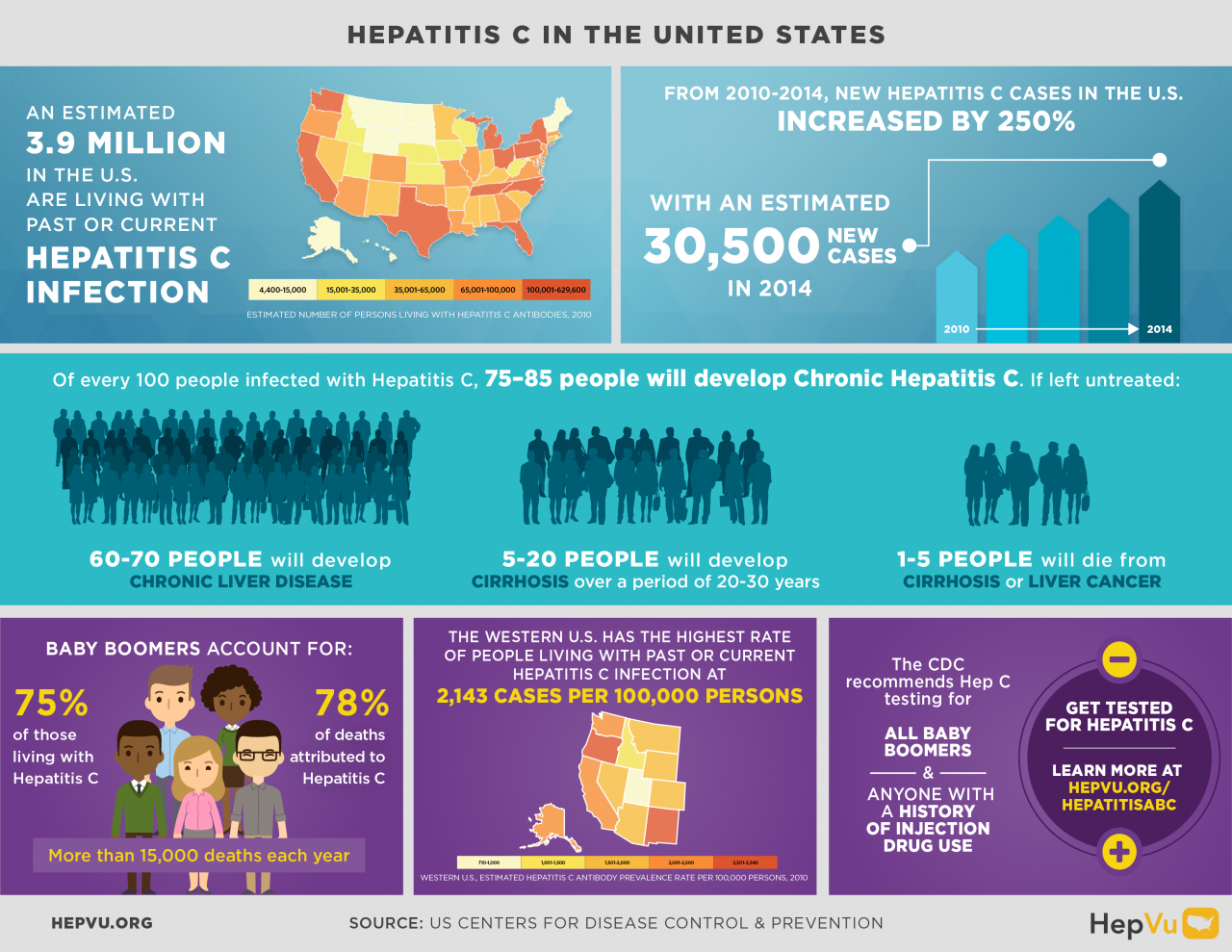

This is a question a number of carriers are being asked today. Roughly a year ago with the onset of the pandemic a majority of carriers introduced underwriting restrictions to deal with COVID's potential impact on various age groups, and especially those age 65 and older with comorbid health conditions (see COVID-19! What Have You Done to Underwriting?). Since then carriers have learned a lot about COVID and its effect on mortality. Discussions with several carriers indicate that their mortality impact is mostly in the 75 and up age groups and with insureds whose policies have been...

Several underwriting tools have been adopted by carriers to issue coverage faster, in many cases without the need for insurance exams or requirements such as a traditional APS. Some of these tools are new, while others have been in use previously, but have recently been enhanced to streamline the underwriting process. These tools often impact cases that run through an accelerated or streamlined underwriting process (for purposes of this blog, we will refer to such processes as "expedited underwriting"), and may also impact cases that follow a more traditional underwriting path. Informati...

- A Virtual Panel Discussion Featuring Experts in the Field of Life Reinsurance - DuWayne Kilbo, Moderator I'm extremely delighted to have available three distinguished speakers from the life reinsurance side of our business for Windsor's first Virtual Panel Discussion! With so much going on today as it pertains to COVID-19 and the evolution of the life insurance industry, this is an opportunity to hear from well-known and highly regarded reinsurance industry executives for their input and thoughts on various topics where they provide support and guidance to the industry. Also, we will h...

COVID-19, in addition to being a terrible pandemic, has brought a halt to business as usual for most every industry imaginable. And life underwriting has not been granted an exception. Among other things, we have seen additional scrutiny placed on certain medical impairments, maximum age and rating limitations imposed, and a reduction in internal retention at some carriers. However, we are also seeing changes—positive changes—occur in underwriting. Underwriting progress has been made using data sources to forgo exams and to get coverage approved quickly and non-invasively—whi...

"I haven't been everywhere, but it's on my list" - Susan Sontag High net worth individuals and families exist all over the world. In today's global economy, you probably have clients with friends or relatives living abroad who are looking to buy life insurance from U.S. based companies. Whether for business planning, wealth transfer, legacy planning, wealth accumulation or family protection, many foreign nationals are motivated by having monies outside their country of residence. They desire the stability of US dollar denominated coverage, asset diversification and protection again...

Algorithmic and Predictive (aka Accelerated) Underwriting Hits a Speed Bump in New York In January of this year, the New York Department of Financial Services (DFS) issued an Insurance Circular Letter on the Use of External Consumer Data and Information Sources in Underwriting for Life Insurance. According to the DFS, the purpose of the Letter was "to advise insurers authorized to write life insurance in New York of their statutory obligations regarding the use of external data and information sources in underwriting for life insurance." While on the surface this seems like a rath...

Throughout my career I've had the good fortune to be associated with a number of individuals and organizations that move and shake the life insurance underwriting profession. They include many industry thought-leaders – among them are chief underwriters, actuaries, medical directors, reinsurance leaders, insurance lab and exam leaders, data providers and others. They represent a wealth of knowledge and insight about the state of the underwriting profession, always looking towards what's impacting the industry today and what they expect to impact the industry tomorrow. So what's at the to...

Historically, there have been very few underwriting niches that truly provided expansive new sales opportunities. Life insurance companies have sometimes, often accidentally, discovered market segments that were being assessed based on outdated actuarial data or medical information, and tried to target those segments with more aggressive underwriting offers. But mostly, when I have come across various intriguing niches over the years, many are too narrow in scope and not all that significant in terms of the potential market size. But recently, I discovered what I think is an exception. ...

Known scientifically as cannabis and commonly referred to as weed, pot, and many other slang terms, marijuana is one of the most widely used recreational drugs in the US today, and is also used in the treatment of various medical disorders. According to the National Survey on Drug Use and Health (United States, 2002-2014), the 18-34 age group has the greatest incidence of marijuana use. What is important to note, however, is the 55 plus age group is showing the greatest increase in use. Males outnumber females in use by 2 to 1. At present, marijuana is legal for recreational use in nine states...

Being fed by our aging producer population, the under-insured and under-served markets, the $15 trillion plus insurance gap, and the search for new and easier ways to access markets—especially the technologically inclined millennials— life insurance companies are beginning to turn the traditional underwriting process on its head. And early results indicate that they are finding some success. Much of what we have seen so far has been positive and a welcome transformation of an otherwise archaic, invasive and time-consuming insurance acquisition process. However, these changes have implications ...

The tension is palpable. Underwriting is being turned on its head, driven by big data, automation, alternative risk assessment tools, and more predictive underwriting models and processes augmented by analytics. Go to any underwriting industry meeting and there will be considerable time and energy devoted to one or more of these topics, along with a fair amount of angst among the underwriting folks present. Traditional and new industry players speak about the latest risk assessment models and tools, back-tested through hundreds of thousands of client records and data points, producing mortalit...

You've met with the clients and their advisors on a few occasions and the time has come to take an application and submit underwriting information to the carriers. However, what you hear next stops you cold: "Our son's friend is also in the business and we want him to shop our application as well to be sure we are getting the best offer and premium available." You pause and think. For several reasons you know that it's never a good idea to pit production sources against one another with multiple carrier submissions. It can complicate matters and often results in an inferior offer and a higher ...

Of all the progressive things the life industry has done in the past few years to advance underwriting standards and make it easier to do business, one area significantly lagging is charitable life underwriting. In charitable situations, the maximum amount of coverage available across almost every carrier in the industry is based upon a multiplication factor—typically 10—of one's past annual giving to a charity. So if an applicant on average has given $10,000 annually to a particular charity and desires to leverage this giving by allowing the charity to own life insurance on his life, he would...